War is the worst thing that can happen to a state and its citizens, not only from a humanitarian perspective but also economically. While there may be winners and losers from a military standpoint in an armed conflict, economically, it always ends in a "draw".

But Ukraine at least retains prospects for a post-war "great leap forward". Meanwhile, the future for the aggressor country's economy looks bleak, regardless of the military outcome of the confrontation.

Size matters

You can't erase joint economic history. This is precisely why the dynamics of Gross Domestic Product (GDP) in Ukraine and russia followed absolutely identical trajectories after the collapse of the USSR.

This similarity persisted even after the start of the major war when former "fraternal union republics" became sworn enemies.

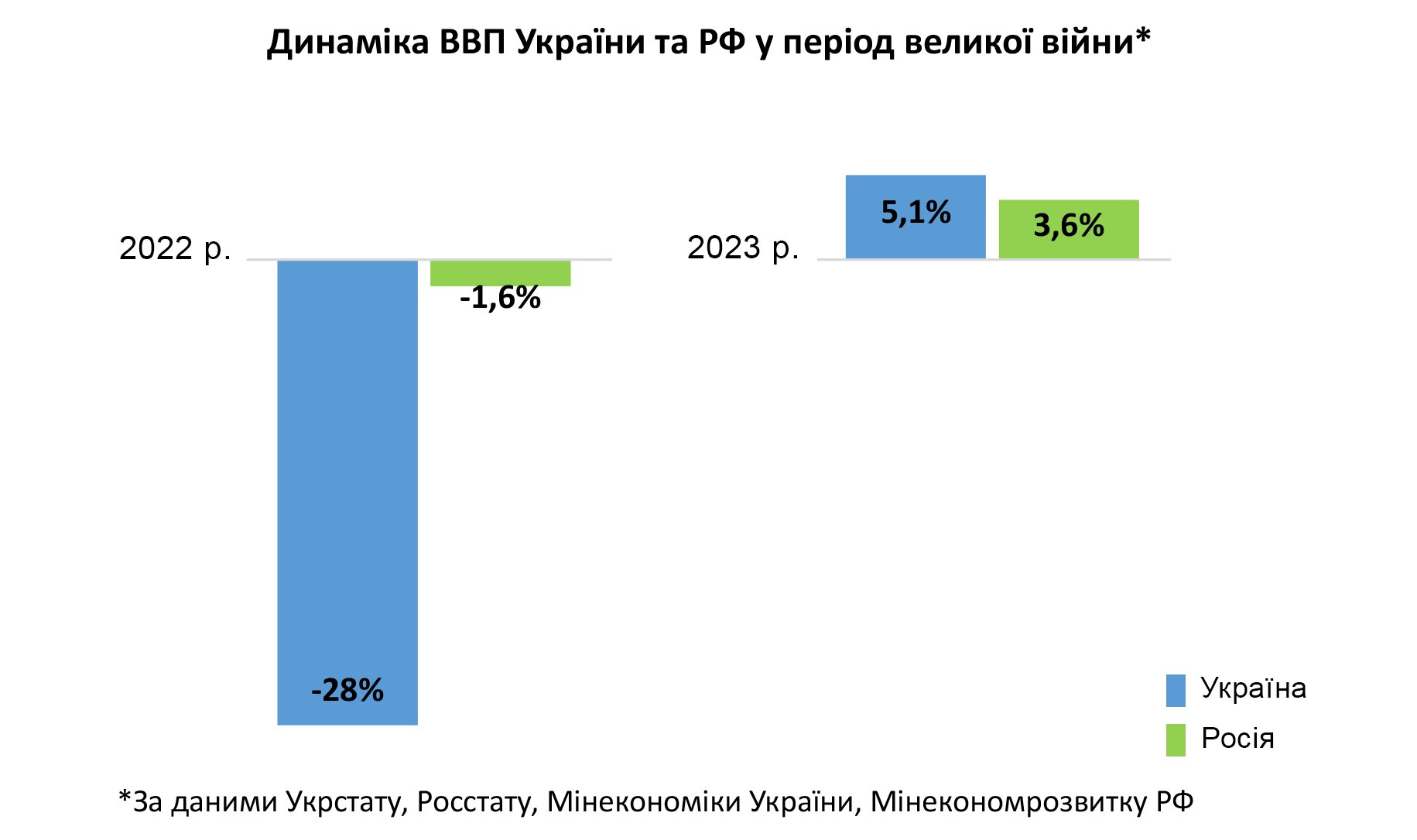

Dynamics of the GDP of Ukraine (blue) and the russian federation (green) during the Great War (according to Ukrstat, Rosstat, Ministry of Economy of Ukraine, Ministry of Economic Development of the russian federation)

Infographics show that the Ukrainian economy suffered much more in the first year of the war. This is due to the scale effect: it's not that the russian economy is more powerful (more than 60% of its income comes from exporting energy resources, so what power is there really?). It's just bigger. Therefore, it's more resilient to any crises. In other words, during a storm, it's much easier for a small boat to sink than a large tanker, even if it's powered by steam engines from the beginning of the last century.

And of course, russia was greatly aided by record-high world prices for energy resources. This resulted in soaring export revenues, despite fairly harsh economic sanctions imposed by Western countries.

Ukraine also has oil and gas, but not in the quantities that would allow trading them on external markets. Plus, there's the blockade by the russians of the Black Sea ports, through which most of Ukrainian exports flowed.

Dynamics of export revenues of the economy of Ukraine (blue) and the russian federation (green) during the Great War (according to Ukrstat, Rosstat, the State Customs Service of Ukraine, the Federal Customs Service of the russian federation, billion dollars)

Therefore, the total direct losses of the economy for 2022 in monetary terms were not in Ukraine’s favor: $38.27 billion and $21.35 billion GDP (in 2021 prices). Additionally, there is the damage from the destruction of Ukrainian factories, roads, and bridges by the aggressor. A year ago, it reached $400-500 billion, according to estimates from the presidential office.

Comparing the data for 2023 allows us to say that the Ukrainian economy coped with the military crisis much more successfully - with a growth of 5.1% compared to russia's 3.6%. But, again, it's about the scale effect. Even with a smaller GDP growth, russia completely offset the previous decline. Whereas we are still very far from returning to pre-war levels.

OstroV previously noted that (in both cases) this growth was not due to a real economic upturn, but rather an increase in state military expenditures.

As for exports, now it has declined on both sides of the front line. Tougher sanctions, declining global prices for energy resources - these factors last year wiped out $167.4 billion in foreign trade receipts for russia.

For Ukraine - "only" $8.2 billion, so it seems like a winning position. But Ukrainian exports have been declining for the second consecutive year.

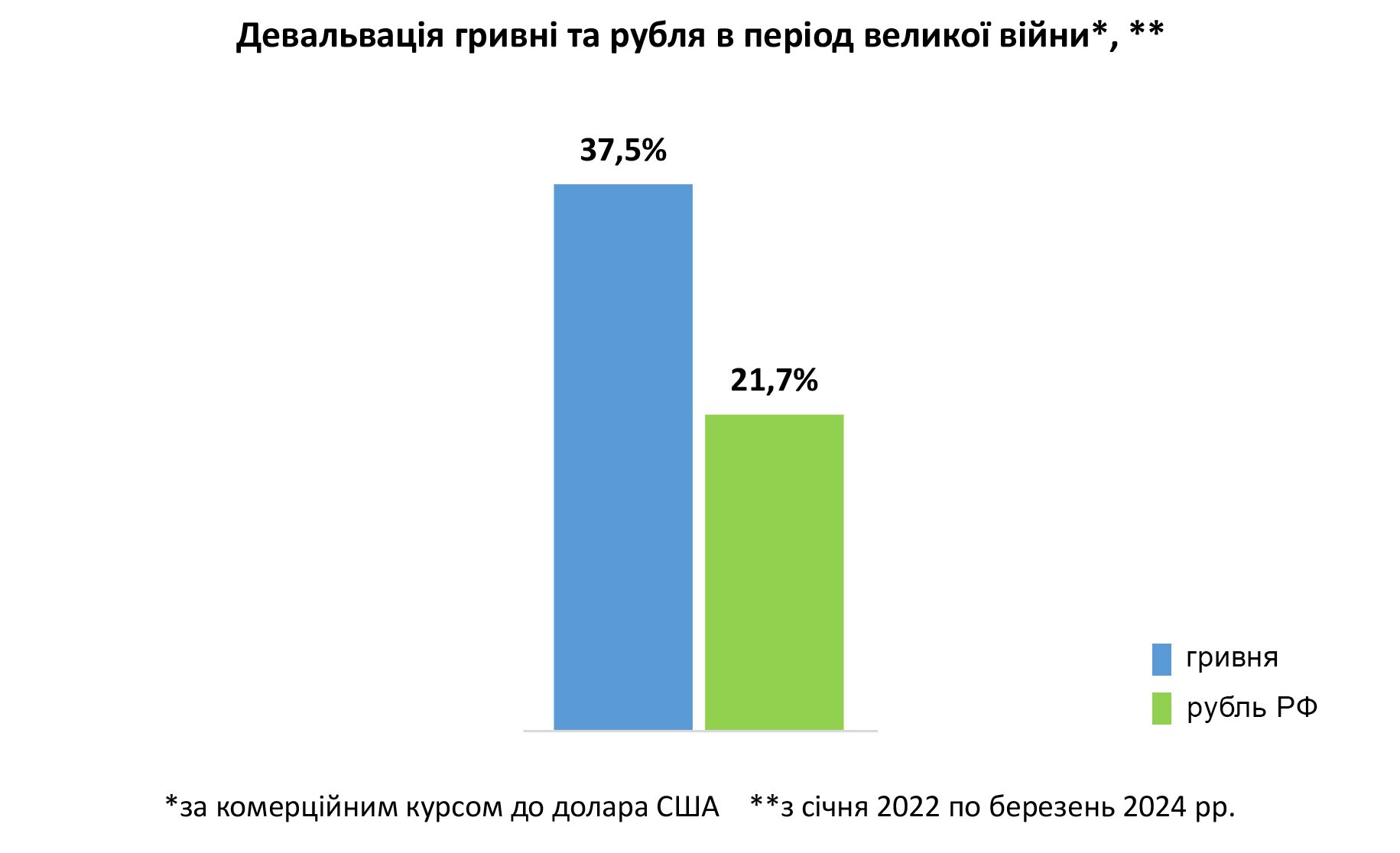

Additionally, on both sides of the front line, the war has devalued the national currency. The ratio of devaluation once again shows that the economy of the aggressor country suffered less.

Devaluation of the Ukrainian hryvnia (blue) and the russian ruble (green) during the Great War (at the commercial exchange rate to the USD from January 2022 to March 2024)

However, economic statistics are just part of the overall picture. Looking at the results of two years of the major war, one cannot rely solely on numbers. There are also very important factors that are difficult to calculate on a calculator.

Ukraine: great perspectives

Ukraine has received customs and transportation "visa-free" access from the European Union. This is the most significant development. All import duties and anti-dumping investigations have been lifted for Ukrainian goods. The European market is now fully open to Ukrainian producers.

Ukrainian truckers can now deliver products to European customers without restrictions (previously, there was a system where a limited number of special permits were issued annually for the entry of freight vehicles from Ukraine).

These preferences are granted temporarily until July 1 of this year. It is evident that official Kyiv will seek their extension, and the chances of success are quite high.

The mere existence of such a case provides a strong position in negotiations with the European Commission regarding permanent customs and transportation "visa-free" access.

Ukraine has become a full member of the integrated European energy system ENTSO-E (associated membership was granted in 2017). This significantly increases the possibilities for importing and exporting electricity.

Previously, the transmission capacity from the western direction to the Ukrainian energy system was only 0.5 GW, but now it is 1.7 GW. The potential for electricity exports from Ukraine to the EU reaches 2.5 GW of transmission capacity.

In monetary terms, selling electricity on the European market is capable of generating about 70 billion hryvnias annually, as previously noted by Prime Minister D. Shmyhal. Moreover, the major war has created conditions for the development of "green" energy.

Government officials have come to understand that this is not just about ecology. It's also about decentralizing the energy system, ensuring uninterrupted energy supply to critical infrastructure (hospitals, etc.). Before the full-scale invasion of russian troops, this factor was not even considered.

Similarly, the government has looked at the problem of the export structure of the Ukrainian economy from a different angle. They knew before that trading raw materials on external markets is not ideal; it's much more profitable to sell finished products made from these raw materials. But it became crystal clear only when the russians blocked the Ukrainian Black Sea ports, through which grain and iron ore were exported (and it turned out that transporting them by rail to Baltic ports was very problematic). It became evident that there might not have been any issues if we had been exporting pasta and steel products made at Ukrainian plants from this grain and ore. Since delivering finished products involves container shipping, which is more flexible and versatile in terms of logistics (the possibility of using railways and road transport, in addition to maritime transport).

These are the very prerequisites for post-war economic growth mentioned earlier. They also include the development of the military-industrial complex. Previously, it was considered just one of the additional options. Now it is clear that it is an absolute necessity.

Among other things, agreements have been reached with the German conglomerate Rheinmetall to build an ammunition plant in Ukraine (currently at the memorandum stage) and with the Czech company VOP CZ (contracts have already been signed for the construction of a plant for the production and repair of armored vehicles).

Returning to the consequences of the Black Sea blockade, it should be noted that it "revived" the Ukrainian Danube ports, which were in a state of "quiet decline" before the war. In 2023, "Izmail", "Reni," and "Ust-Dunaisk"ports increased cargo handling sixfold compared to pre-war levels, to 29 million tons, according to the Ukrainian Sea Ports Administration.

At the Danube ports, the operation of 20 new cargo terminals has begun. Plans include 15 more investment projects totaling over $120 million, including through loans from the European Bank for Reconstruction and Development.

Furthermore, despite all the problems with freight transportation in the western direction, Ukraine's integration into the EU's unified railway network has entered the practical stage. In December 2023, the United States Agency for International Development (USAID) and the Ukrainian Railways PJSC (Ukrzaliznytsia) signed a memorandum, providing for technical support for the construction of a railway Euro track from the Mostyska station (on the western border) to Lviv.

In the future, the plan is to extend the railway Euro network to Uzhgorod, Kovel, and Chernivtsi. Then – to Kyiv. And in the long term – even to the eastern regions. These are long-term projects worth hundreds of millions of dollars each.

Finally, the major war has completely shifted Ukrainian nuclear energy from russian to Western technologies. Previously, it was only about partial use of adapted fuel from Westinghouse Electric Company in Soviet/russian reactors at Ukrainian nuclear power plants.

But already in June 2022, National Nuclear Energy Company "Energoatom" and Westinghouse signed a contract for the construction of AR1000 reactors to replace the VVER-1000, which is produced by "Rosatom" and whose operational life ends in the 2030s-2040s.

These are also large and high-tech projects, with the construction cost of one such reactor being around $2.5 billion. Obviously, this is much more expensive than russian counterparts. But the former "brothers" simply left no choice for the Ukrainian leadership. And in any case, these are very significant investments in the post-war economy.

Russia: a "peripheral" future

The impact of Western sanctions on the russian economy has already been extensively discussed by OstroV. This is also a factor that defies precise assessment.

It is impossible to determine the cost of discontinuing supplies of high-tech products (microchips, computer graphics cards, industrial equipment, etc.). These are items that exacerbate russia's technological backwardness.

They cement its place on the "sidelines" of the global economy as a supplier of energy resources. The European countries' abandonment of russian gas is already a fait accompli. They will not return to purchasing it even after the war. To never again become subject to gas blackmail by the kremlin.

And, as mentioned earlier, attempts to replace gas exports to the EU with China have ended in failure. Therefore, russia's share in the structure of global energy resource supplies will now be very modest. Importantly, not for just a year or two. But for decades.

It is also difficult to calculate the losses of investments that could have flowed into the russian economy but now certainly will not come in the coming decades. Because putin has deprived it of the most crucial thing – investor confidence.

The kremlin responded to the refusal of several major international companies to operate in the russian market (due to sanctions) by introducing the so-called "state management" of their russian assets.

In simpler terms, investors had their plants, factories, and power stations seized in russia. This list includes energy companies (Finnish Fortum Oyj, German Uniper SE), breweries (Danish Carlsberg, Dutch Heineken), French dairy conglomerate Danone, and many others.

Now, here's the question: who will want to open their businesses in russia after this, even if the sanctions are lifted? Obviously, it will take many years before major foreign businesses "forget" about these cases.

By Vitaliy Krymov, OstroV