Ukraine's leading investment company, Dragon Capital, confirmed its previous forecast for the economy this year in February: a Gross Domestic Product (GDP) growth of 4%. Other key indicators are also expected to be positive, but only if...

The hryvnia was predicted to maintain its strength

The most significant assessments in this forecast concern inflation and the exchange rate. The company still anticipates that annual inflation (the rate of price growth for goods and services for the population) will accelerate but will not exceed "acceptable limits". It is expected to reach 8% compared to 5.1% in 2023.

This also implies that there will be no abrupt surge in utilities tariffs. It is also possible to agree with Dragon Capital's view that "low inflation allows for a slight weakening of the hryvnia exchange rate, aiding the budget".

This "aid" is expressed in increased revenues to the budget from excise taxes and value-added tax on imported goods. These taxes are paid in hryvnia but calculated in dollars and euros. Thus, maintaining the current tax rates will result in higher payments when the hryvnia weakens against hard currencies.

However, Dragon Capital notes that "even with a devaluation of the national currency by up to 10%, inflation at the end of the year remains unequivocal". In other words, it will not reach 10%. Such inflation can indeed be considered "mild" for the population while simultaneously contributing to the "revival" of the economy.

Nevertheless, the company expects the exchange rate to reach $1/39 UAH by the end of the year. Therefore, any depreciation of the hryvnia in the first half of the year will be compensated for, and it will return to its initial positions (as of December 2023).

As a result, a record GDP in dollar terms is forecasted for the year: $203 billion. The infographic below illustrates that the previous highest achievement dates back to 2021.

Gross domestic product of Ukraine, billion dollars (according to the International Monetary Fund)

All of this is possible if two main conditions are met. The first is receiving the full $37 billion of external financial support planned for this year in the state budget.

In general, this figure can be considered realistic, as it already includes the anticipated reduction in foreign aid (in 2023, it amounted to nearly $43 billion against a planned $38.4 billion).

The second condition, as formulated by Dragon Capital, is: "if the security situation does not deteriorate".

In other words, they do not expect improvements (the company previously assumed that full-scale war would end in 2024). However, they at least hope that things will not get worse.

Assessing the realism of this condition is much more challenging than for condition number one. Here, forecasts are needed not from economists, but from the General Staff of the Armed Forces of Ukraine and the Office of the Supreme Commander-in-Chief.

Reasons for optimism

"I remain optimistic about 2024", - said Dragon Capital founder T. Fiala, commenting on the published forecast. According to him, the main reason for economic optimism is the recovery of export shipments through Ukrainian Black Sea ports. They have almost returned to pre-war levels.

Before the blockade, these ports exported an average of 11 million tons of cargo per month. In January alone, the figure reached 7.5 million tons plus 2 million tons through the Danube ports. And, according to T. Fiala, there is potential for further improvement in these results.

In turn, Deputy Prime Minister O. Kubrakov announced in February that the operation of the Black Sea "corridor", which opened up exports, significantly improved the state budget's revenues.

"The Ukrainian humanitarian corridor in the Black Sea has been established. The good news is that we are beginning to return to previous figures in key export sectors such as agriculture, metallurgy, etc. Overall, we see that tax revenues are higher than anticipated in the budget - by 25-30% depending on the group of goods. This is more than we expected", - he said in a media comment.

Boosting the budget is not only aided by the resumption of maritime exports. The State Tourism Development Agency reported at the end of February that tax revenues from tour operators and hotels increased by 32% to 2.05 billion hryvnias by the end of 2023.

This is 92% of the pre-war level. Obviously, the revival of the tourism industry is not related to the Black Sea ports; it is a signal of the overall economic recovery. There are also several other positive economic signals to note.

A survey conducted by the UN Development Programme (UNDP) by the end of 2023 indicated that 82% of small and medium-sized enterprises, which had ceased operations due to the large-scale russian invasion, had resumed work. The survey results were published at the end of February.

Last year saw record revenues to the state budget from the sale of licenses for the development of mineral deposits - 2.4 billion hryvnias, according to the State Service of Geology and Mineral Resources. A total of 465 special permits for subsoil use were issued. This indicates a recovery in the mining industry from its dormant state.

As for the banking sector, its stability is characterized not only by the dynamics of profit, as shown in the infographic below, which exceeds pre-war levels. Much more important is the reduction to a record low (less than 0.8%) of the share of refinancing loans from the National Bank of Ukraine in the total liabilities of commercial banks. The previous record dates back to the "golden" year for the Ukrainian economy in 2006.

Results of the work of the banking sector of Ukraine, net profit in billion UAH (according to the National Bank)

This means that banks currently do not need refinancing. The need for it arises when there is a mass outflow of funds from deposit and current accounts (which is the most terrifying scenario for the banking system).

Looking at the situation in the metallurgical industry, the second most important sector of the Ukrainian economy, the overall picture is negative.

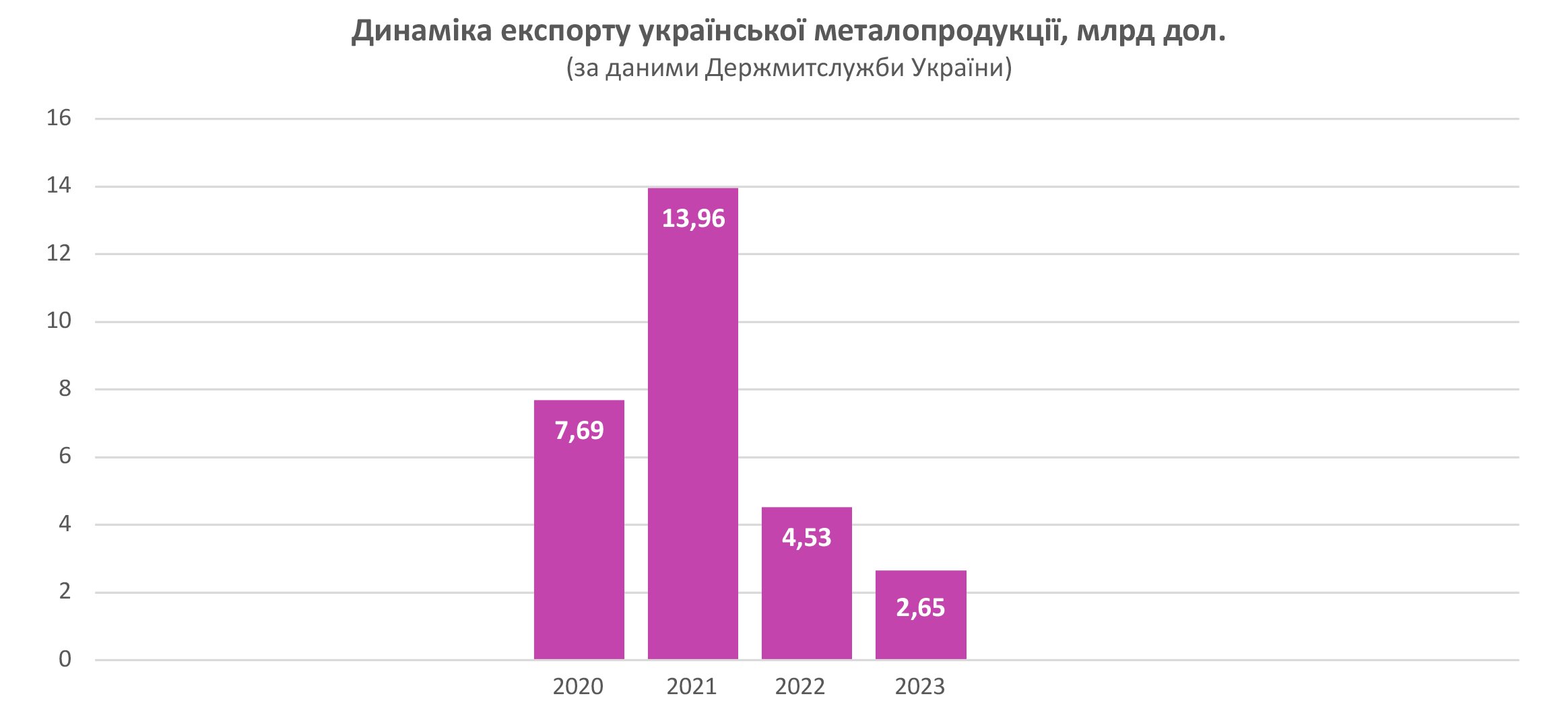

Dynamics of export of Ukrainian metal products, billion dollars (according to the data of the State Customs Service of Ukraine)

But if we look at the export dynamics of recent months, it is quite promising.

In particular, in January of this year, the indicator for metal products (and the export of finished products is many times more important than raw materials) increased to 400.4 thousand tons compared to 91.6 thousand tons in January 2023.

So, it can be stated that last year Ukrainian metallurgy "hit rock bottom", but now there is an upward rebound.

Financial matters

In peacetime, the government's task regarding business is straightforward: not to hinder its development. During wartime and post-war recovery, this is not enough. In the aforementioned UNDP survey, half of the entrepreneurs emphasized that their business would not survive without government assistance.

Loans, employment programs, tax reductions, and grants have become crucial for survival, according to survey participants. All these things are funded either from the state budget or through foreign aid.

One of the main drivers is the government program "5-7-9", which provides loans to enterprises at 5%, 7%, and 9% per annum in hryvnias. The rest of the interest payments are covered by the state.

According to the National Bank, in 2023, the volume of loans under the "5-7-9" program increased by 34%. The Ministry of Finance clarifies that a total of 23,973 thousand loans were issued, amounting to 97.2 billion hryvnias. This is not too much, but not insignificant either.

So, it can be said that the state is coping with its tasks regarding business in wartime conditions at a "satisfactory" level. In other words, it's a solid "B".

The infographic below illustrates the current situation of Ukrainian businesses quite vividly.

The target structure of loans under the "5-7-9" program (according to the Ministry of Economy of Ukraine) (investment loans, refinancing of previous loans, anti-crisis loans, loans for anti-war purposes, agricultural loans, other purposes)

It's evident that loans in the agricultural sector financed current needs: purchase of seeds, fertilizers, feed, herbicides, machinery, and fuel for planting/harvesting campaigns.

Less than every tenth small/medium enterprise can afford to develop right now. The rest are focused on survival.

The business's needs for recovery in 2024 were estimated by the World Bank (WB) at $5.8 billion, including $4.2 billion in investments and another $1.6 billion in operating capital. Minister of Economy Yuliia Svyrydenko expressed confidence that companies and enterprises would receive this funding.

"This is the overall financing need of the sector, which we intend to provide with our international partners", - she said, commenting on the WB report published in February.

Even if last year's volumes under the "5-7-9" program are maintained, almost half of the necessary financing is covered. The World Bank is ready to allocate $500 million in 2024 to support this program, according to Svyrydenko. Plus, there are other sources.

President of the European Bank for Reconstruction and Development, Odile Renaud-Basso, announced at the end of February that from 2024 to 2028, the EBRD is prepared to invest up to €3 billion annually in the Ukrainian economy. Primarily, these are loans for enterprises.

Finally, this year, official Kyiv expects to receive €4.4 billion from Brussels. This is the interest income (for 2023) from government-owned russian securities "frozen" in EU countries after the full-scale invasion.

"There is cautious optimism that the EU Council will make the decision by the end of June 2024", - noted Deputy Minister of Justice I. Mudra in a February media interview. These and other positive signals are shaping corresponding sentiments in the business environment.

The February Business Activity Expectations Index (calculated monthly by the National Bank based on its own survey of managers and business owners from various sectors of the economy) rose to 47.5 points compared to 41 points in January.

For context: a neutral indicator is considered to be 50 points. Less indicates negative business activity expectations, above 50 points indicates positive. Not bad for a country that has been in a state of full-scale war for the third year running.

By Vitaliy Krymov, OstroV