The National Bank of Ukraine (NBU) managed to prevent the hryvnia from collapsing in December-January. The cost of doing so was high. In the last month of the previous year, the NBU had to sell a record $5.3 billion on the interbank market.

In January, to curb the currency deficit that was driving up the dollar exchange rate, the required amount was only slightly lower. From January 1 to 17 alone, $2.05 billion was spent for this purpose. That means, on average, $1 billion per week was leaving the NBU’s reserves and entering the market.

Given the existing volume of these reserves ($43.8 billion as of January 1 this year), it’s reasonable to agree with the assessment of the NBU’s Director of Monetary Policy and Economic Analysis Department, V. Lepushynskyi, that such expenses "do not look like a harbinger of an apocalypse".

However, it is also hard to argue with the chairman of the parliamentary committee on financial policy, D. Hetmantsev, who believes that the National Bank should start implementing administrative measures to prevent further depreciation of the hryvnia and stabilize exchange rate fluctuations.

Why the hryvnia started to weaken

In recent years, December and January have traditionally been a difficult period for the hryvnia. First, the largest budget expenditures occur in December. According to V. Lepushynskyi, part of this hryvnia enters the foreign exchange market, meaning it is converted into dollars and euros.

Second, additional pressure comes from military spending (import of weapons), which is paid for in hard currency. Thus, the winter weakening of the hryvnia was not a major surprise for the National Bank. It can now confidently be attributed to seasonal factors.

Finally, the acceleration of inflation (the rate of growth of consumer prices) to 12% in 2024 compared to 5.1% in 2023 contributed to growing distrust in the hryvnia—both among the population and businesses. As a result, there was a stronger desire to exchange the depreciating national currency for something more reliable.

Thus, the exchange balance in December was negative. Individuals (mainly not ordinary citizens but business representatives registering their enterprises as individual entrepreneurs) bought $2.94 billion worth of foreign currency from banks and sold $1.63 billion. In total, $1.31 billion in cash left the banking system.

That’s quite a lot. For comparison: in the pre-crisis year of 2012, individuals bought $1.65 billion and sold $1.44 billion. Yes, the balance was also negative, but seven times smaller than now. As they say—feel the difference.

Because of this, the NBU had to dig deep into its reserves, spending over $8 billion in two winter months to meet the rising demand for dollars and prevent the hryvnia from collapsing.

The state regulator handled its task. In December 2024, the hryvnia weakened by only 1% against the dollar. In December 2023, the drop was much more significant—4.5%. Moreover, thanks to foreign financial aid, the National Bank almost came out unscathed.

As noted, in December, the interbank market interventions totaled $5.3 billion, while financial inflows from Ukraine’s partners and allies amounted to $9.5 billion.

That means that despite the record-high currency expenditures of the NBU, its overall financial account balance remained positive—at +$4.2 billion. As a result, interbank currency reserves (ICR) grew to $43.8 billion by the end of the year. The regulator has never accumulated this much before.

International currency reserves of Ukraine, billion dollars, according to the National Bank (as of December 31)

According to V. Lepushynskyi, this allows for a confident outlook on the near future. "The reserves are sufficient for the NBU to continue maintaining the stability of the foreign exchange market, including offsetting the structural currency deficit and smoothing exchange rate fluctuations", - he states.

According to the Director of the NBU's Monetary Policy and Economic Analysis Department, in 2025, Ukraine expects to receive about $38 billion from its partners.

"This means the NBU’s ability to maintain an adequate level of international reserves and ensure stability in the foreign exchange market will remain high", - he concludes.

Hanging by a thread

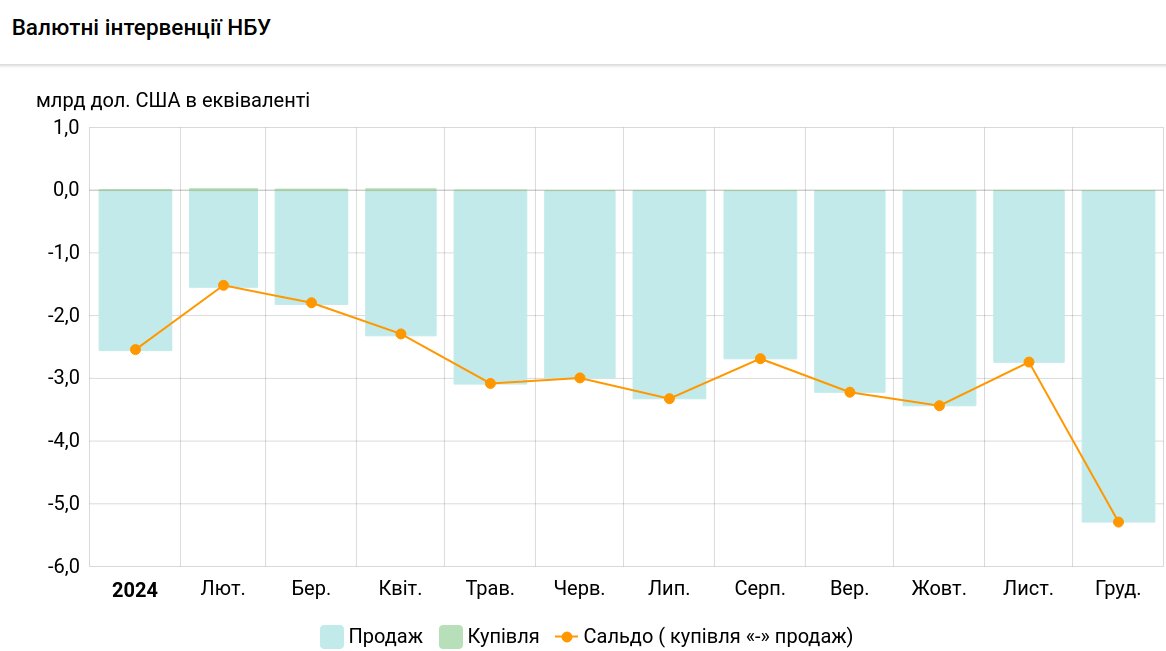

Despite this, the situation with the hryvnia exchange rate cannot be called cloudless. The infographic below shows that in 2024, the NBU acted exclusively as a seller on the interbank market.

NBU foreign exchange interventions, in equivalent of billion USD

A total of $34.94 billion was sold, while only $0.13 billion was bought. In other words, three-quarters of all foreign financial aid was spent just to prevent the hryvnia from "flying off" somewhere near 100 UAH per USD.

Yes, the economy still had its own foreign exchange revenues: exports of goods and services amounted to $55.58 billion. But this was entirely consumed by imports totaling $70.7 billion, additionally draining $15.12 billion from the economy.

This means that Ukraine’s foreign trade not only fails to support the hryvnia but actually weakens it further. It is clear that under such conditions—where the national currency is held up solely by foreign financial injections—it is difficult to speak of its stability or predict any "bright future".

However, a high-ranking NBU official does not promise such a future either. "The NBU's goal is not to maintain the exchange rate at a fixed level. The NBU's goal is to maintain the stability of the foreign exchange market", - he warns.

Translated into plain language: "We won’t allow a collapse of the hryvnia, but there will be a slow decline". But this won't protect Ukrainians' hryvnia savings from depreciation—or from the rapid rise in prices (read: the impoverishment of the population).

Response

The situation looks like a vicious cycle. The devaluation of the hryvnia fuels inflation. Inflation, in turn, drives panic demand for dollars and euros. And this further weakens the hryvnia. And so on.

However, the NBU is not backing away from its commitments to curb inflation—even though it clearly failed to meet its targets last year.

As of May 2, the state regulator had forecasted inflation at 8.2% for 2024. By August 1, the bar was raised to 8.5%, and by November 7, to 9.7%. In the end, it reached 12%. That is, the pace of consumer price growth turned out to be much more "aggressive", jumping past the double-digit threshold.

According to V. Lepushynskyi, the National Bank plans to bring inflation back within 5%. But… not anytime soon. Within three years. Obviously, a lot can happen in that time.

As noted earlier, exports are no help to the hryvnia. And foreign financial aid is an uncertainty in geometric progression. Its main source right now is the $50 billion loan from the G7, backed by income from "frozen" russian state assets.

Previously, OstroV reported on Washington’s initiative to use these assets as a tool to pressure the kremlin—and return them to their owner, meaning the russian Ministry of Finance and Central Bank, in exchange for signing a peace agreement with Ukraine.

If that happens (and the probability exists), then foreign financial support for the hryvnia won’t disappear completely—but will shrink significantly. With all the consequences that follow.

In that case, the NBU will be left with only currency regulation tools. So far, it has not resorted to them, instead using broader measures. On December 12, the NBU raised the key interest rate from 13% to 13.5%, and then on January 23, to 14.5%.

"This decision is aimed at maintaining the stability of the foreign exchange market, keeping inflation expectations under control, reversing the inflationary trend, and gradually slowing inflation to the 5% target", - the NBU stated.

Thus, the state regulator raises deposit rates for both the population and businesses, as well as NBU deposit certificates for banks themselves, effectively "tying up" the hryvnia supply and preventing it from "spilling over" into the foreign exchange market—that is, being converted into dollars and euros.

For now, this seems to be enough. The media note that the January interest rate hike "slightly exceeded market expectations", meaning banks. However, according to financial analyst A. Shevchyshyn, "the overall devaluation trend (of the hryvnia – ed.) remains".

By Vitaliy Krymov, OstroV